Today, you can open a Chime account in less than two minutes. With revamped offerings from both fintechs and megabanks alike, people expect a smooth, Amazon-like customer experience for everything. Traditional financial institutions must deliver the same frictionless experience while maintaining profitability. In this environment, staying competitive requires more than vanity metrics when marketing your FI's deposit and loan products.

The good news is that there is a platform that makes it easy to do just this, using machine learning to tell you exactly what works. In fact, using the software, you can see at least a 50% increase in funded loans and deposits with no increase in marketing spend. You can tie every single one of your marketing campaigns to funded outcomes and outperform even the fintechs, using the industry's most accurate data to help you start optimizing immediately.

Client Spotlight

One financial institution increased funded applications while achieving a 40% drop in cost per app.

How it Works

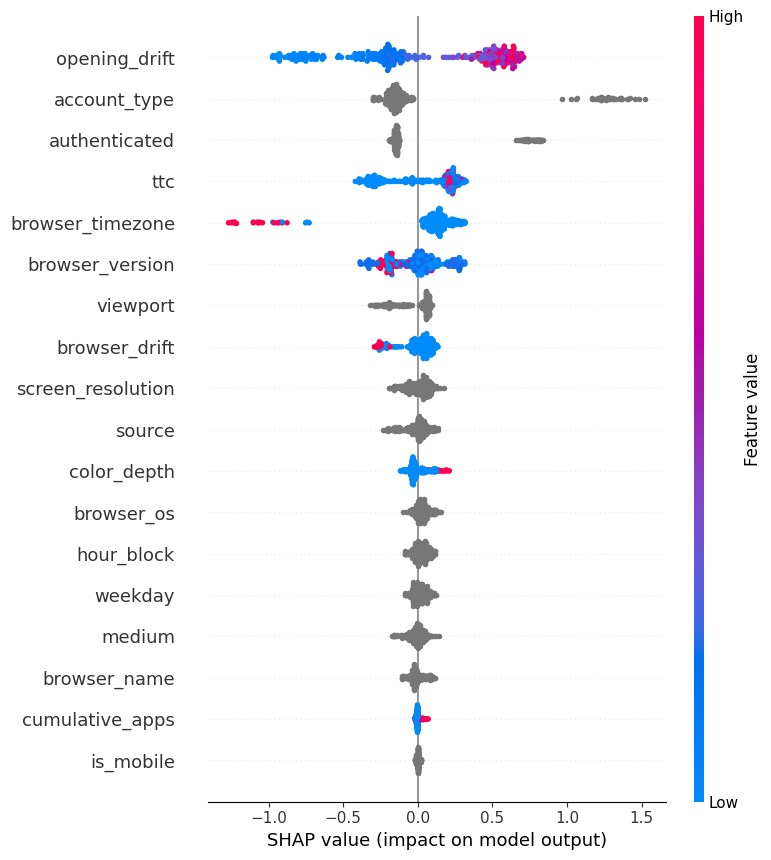

Alpharank tracks the full-funnel — from clicks from ads and emails to website interactions, backend LOS, and account-opening applications. All it takes is adding a single line of HTML to your online site to access otherwise unavailable intelligence.

* Alpharank's Optimizer Model Trained on 6+ Billion Transactions

Alpharank’s click prediction model provides tailored guidance, trained on 6+ billion transactions from 200 financial institutions. FIs leverage the model’s assessment of the probability of a given click to become an approved application to optimize marketing campaigns, improve website funnel, and increase funded loans and deposits — based on insights from 6+ billion data points.

Get Started Today

Get a free trial today with a simple integration — it’s just one line of code to start seeing how 6+ billion data points can transform your financial institution’s growth.

.png)